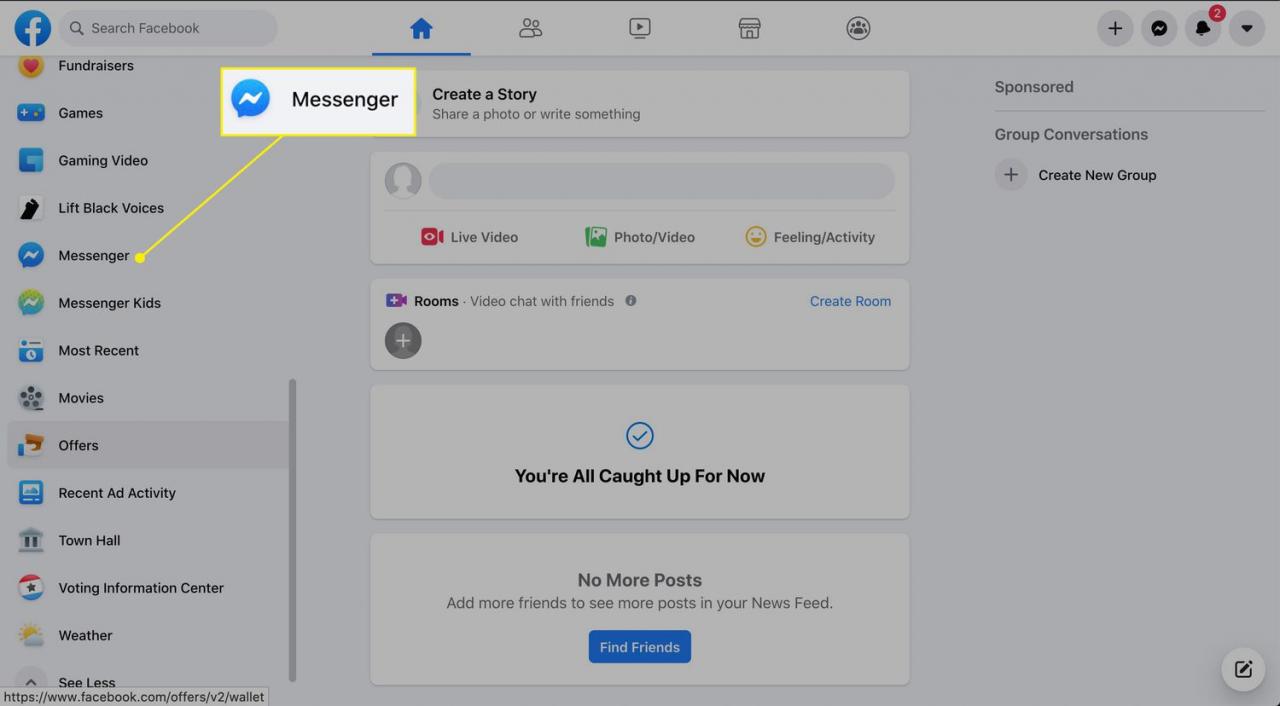

In theory, high-yield bank account are a method for you to earn a much better rate of interest on the money you keep in the bank, in exchange for meeting certain banking requirements. Compared to basic checking accounts– which normally pay absolutely no interest– a high-yield bank account can pay even more than the very best high-yield cost savings accounts if you mark off particular transactional boxes monthly.

That permits some customers to streamline their banking by having all of their funds in one high-paying account instead of needing to siphon off some cash to a cost savings account in order to make a decent return. However as we’ll see, the restrictions on high-yield monitoring makes it not right for everyone.

What’s more, today when banks are providing their highest cost savings account rates in more than 15 years, the additional interest acquired from a high-yield checking account is less than it was when savings rates were low, making them not worth the trouble for many customers.

Key Takeaways

High-yield checking accounts pay a very high yield in exchange for you satisfying specific transactional requirements every month.The most typical requirements are making a minimum number of debit card deals on a monthly basis– such as 10 or 15– and signing up for electronic statements.If you don’t meet all the requirements, you might make practically no interest. This indicates you need to pay more attention to how you use the account than you would with a regular monitoring or savings account.High-yield checking accounts likewise cap how big of a deposit they’ll pay the high rate on, with $10,000 and $15,000 optimums being the most common.You may be much better off keeping your savings in among the best high-yield cost savings accounts, which pays almost as much as the best high-yield checking accounts right now however with less hassle.When cost savings rates drop, high-yield bank account tend to pay more than them, so they might again become a more appealing choice once cost savings rates decline.

How High-Yield Checking Accounts Work

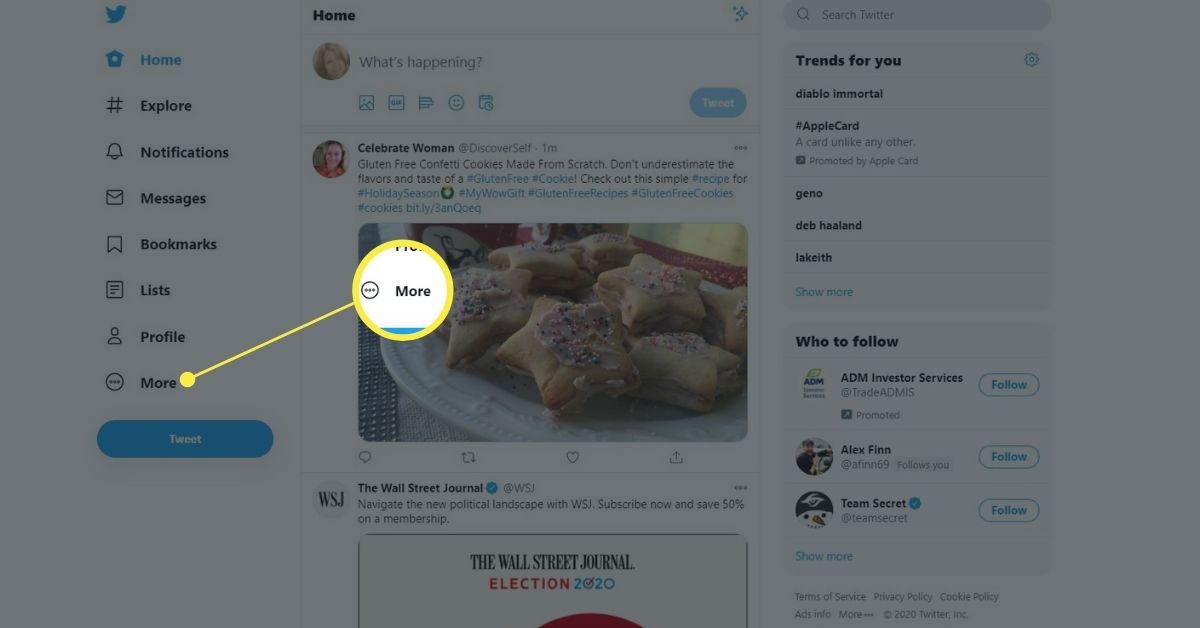

High-yield checking accounts operate under a fundamental premise: The bank or credit union establishes a list of month-to-month account requirements, and when you satisfy those requirements, you’ll be rewarded with a handsome rate of interest on your balance for that month. For this factor, these high-yield products are often called benefits examining accounts.

The most typically needed hoop is using the account’s debit card some minimum variety of times each month. And we’re not discussing three or 4 deals. Usually, high-yield checking accounts need you to use your debit card 10, 12, or even 15 times each month, while other accounts might specify some minimum dollar amount spent on debit.

Other common requirements include:

Direct deposit, sometimes with a minimum dollar quantity specifiedSigning up for electronic banking and logging in at least as soon as per monthConducting some minimum number of bill paysOpening and using a credit card from that organization

In addition, the majority of high-yield bank account need you to register for electronic declarations.

Drawbacks of High-Yield Checking Accounts

There are 3 major restrictions of these high-yield accounts.

1. High-Rate Requirements

Ensuring you satisfy the requirements each month may involve keeping a close eye on the account’s deals, requiring yourself to use your debit card sufficient times, counting the number of times you’ve done so, and perhaps setting a regular monthly tip before each cycle ends, to be sure you’ve fulfilled the requirements prior to it’s far too late.

Some individuals even discover themselves splitting up their grocery cart into 2 or three separate purchases to rack up deals. Simply put, more attention and upkeep is normally required on these accounts if you expect to earn the high-yield rate on a monthly basis.

2. Much Lower Rates if You Don’t Meet Requirements

If you stop working to successfully leap through all of the required hoops in any month, you’ll make an alternate interest rate that is normally a mere pittance. Though the cycle starts anew after every statement, losing out on one or more months of the high-yield rate will considerably decrease what you make from the account throughout a year. The chart listed below programs an example.

3. Rate Caps

If you have a fair little bit of money you’re wishing to position in this account in order to maximize your interest profits, you’ll be dissatisfied to find out that these accounts typically cap the balance on which you can make the exceptional annual portion yield (APY). Maximum caps of $10,000 or $15,000 are the most common, though some accounts specify just $5,000 while a few unusual options allow up to $20,000 or $25,000.

This does not suggest you’re not enabled to keep more in the account. It just means that any balance over the cap won’t earn the high-yield rate (making it smarter to keep your surplus funds elsewhere).

How Today’s High-Yield Checking Rates Compare

Maybe you’re the kind of banking consumer who currently uses their debit card frequently and pays close attention to their account on a regular basis. The requirements above might seem completely doable to you. So just how much do you stand to acquire?

Today, our research study reveals that the best nationally available high-yield bank account rate is 6.00% APY, provided by Orion Federal Credit Union with an optimum balance at that rate of $10,000. In addition, you can currently earn 5.50% APY from Pelican State Credit Union or 5.30% APY from All America Bank. And you can earn between 5.00% and 5.25% from about another 8 alternatives.

That might sound quite attractive, up until you recognize you can make almost as much right now from a high-yield savings or money market account– and with zero hoop-jumping. Our day-to-day ranking of the best high-yield cost savings accounts presently provides a prominent rate of 5.12% APY, while our finest money market accounts list features a leading yield of 5.25% APY.

While it’s real today’s best high-yield checking rates will pay more than a savings or cash market account, it’s smart to determine the advantage so you can decide if it’s worth the compromises. For instance, even if you can earn a full 1% more with a high-yield bank account, on a $10,000 balance without any months of missing the requirements, you’ll net an extra $8.33 per month, or $100 each year.

If the high-yield checking account is simple for you to use and keep track of, that may appear like a win. If the trouble element for you is high, an extra $8–$ 9 in your pocket each month may not seem worth the constant effort.

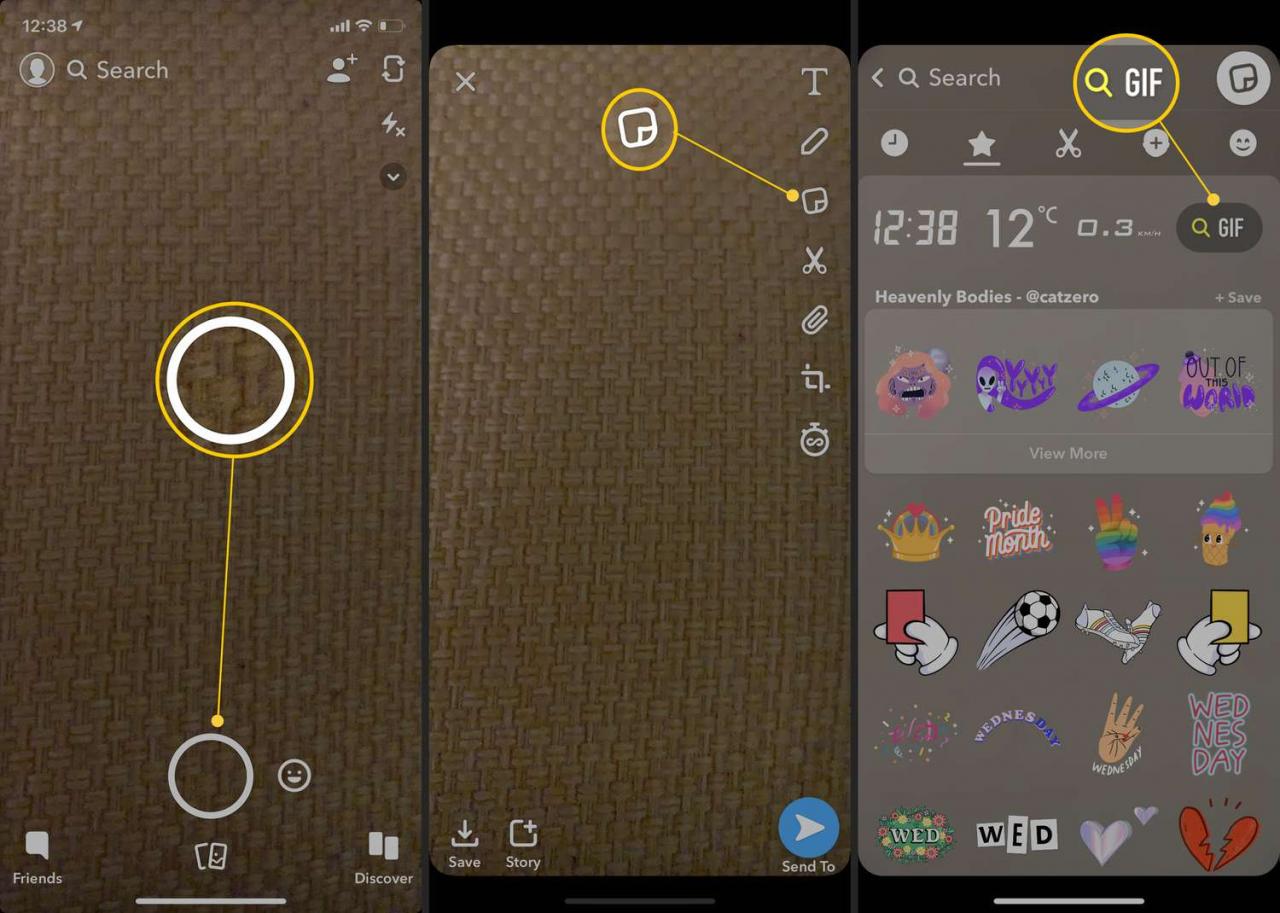

High-Yield Checking May Become More Appealing After Savings Rates Drop

Cost savings account rates are very conscious the federal funds rate, which is set by the Federal Reserve. The Fed has actually been raising the fed funds rate in a series of hikes given that March 2022 in order to battle inflation. Examining account rates are also affected by the fed funds rate however some are slower to respond to rate drops than cost savings accounts are.

When savings rates were lower, prior to the Fed’s existing rate-hike campaign, the yields on benefits checking accounts were more attractive. As you can see in the chart below, the very best high-yield savings account rates were paying simply 0.70% APY prior to the Fed took action.

Now, nevertheless, interest rates on bank account have actually surged, pushing the leading rates on savings, cash market, and lots of CDs accounts above 5%. When interest rates that attractive are simple to come by, the case for a more troublesome high-yield bank account is less compelling.

Things might change in the coming year. Now, it’s expected the Fed will push rates still higher this year. Eventually, however, the Fed will start decreasing the federal funds rate, maybe in 2024. When that takes place, rates on savings and cash market accounts will start to fall.

High-yield checking account rates, nevertheless, could again prove more “sticky,” indicating they may not fall as far or as rapidly as other account rates do. When rates are decreasing, banks and credit unions that are starving to keep deposits require to strive to draw in and keep clients.

Offering appealing high-yield checking account rates may be more doable for them than using a high-yield cost savings account due to the fact that the rates bring in consumers, but only a specific portion of them will have the ability to fulfill the account requirements. Plus, the bank or credit union charges a little charge each time you use your debit card.

So even if high-yield bank account do not sound like a rewarding item to you right now, you might want to keep your eye on them when the rate environment changes, as they could become a much more competitive alternative in the future– if you can fulfill the account requirements.

Rate Collection Methodology Disclosure

Every company day, Investopedia tracks the rate information of more than 200 banks and credit unions that offer cash market, cost savings accounts, and CDs to customers nationwide, and identifies day-to-day rankings of the top-paying accounts. To get approved for our lists, the institution needs to be federally guaranteed (FDIC for banks, NCUA for credit unions), and the account’s minimum preliminary deposit need to not surpass $25,000.

Banks must be offered in a minimum of 40 states. And while some cooperative credit union require you to contribute to a specific charity or association to become a member if you don’t meet other eligibility requirements (e.g., you do not reside in a specific location or work in a particular sort of job), we leave out credit unions whose donation requirement is $40 or more. For more about how we choose the best rates, read our complete method.